36+ what are mortgage backed securities

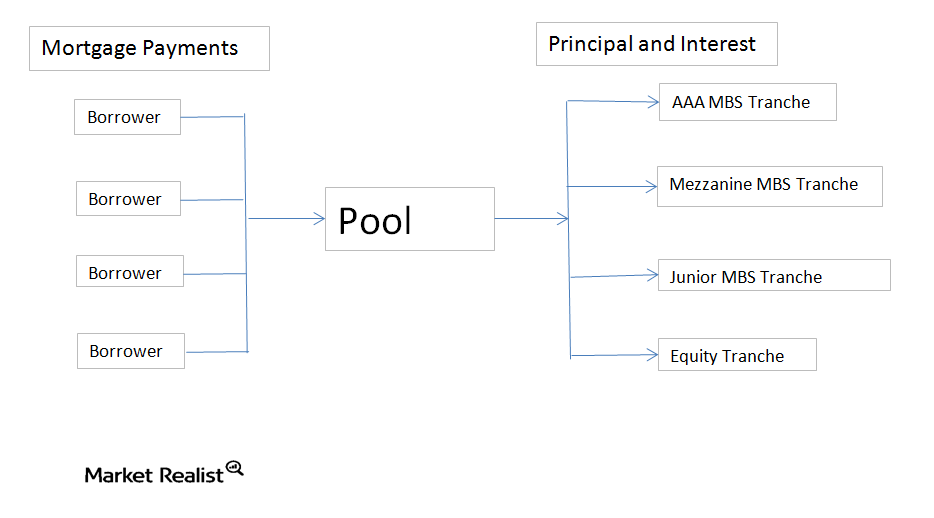

Web ABS is generated through the pooling of non-mortgage investments whereas MBS is formed from the pool of mortgages that are auctioned sanctioned to potential buyers. Web Mortgage-backed securities typically offer yields that are higher than government bonds.

Free 36 Printable Receipt Forms In Pdf Ms Word

Ad Compare the Best House Loans for March 2023.

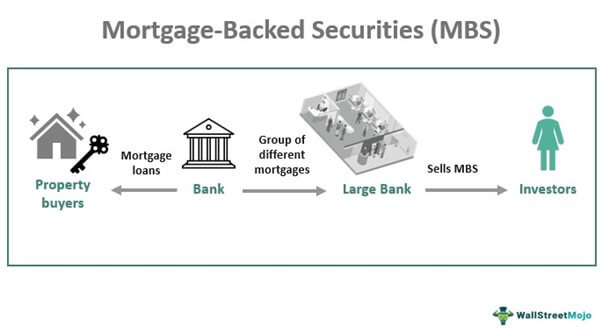

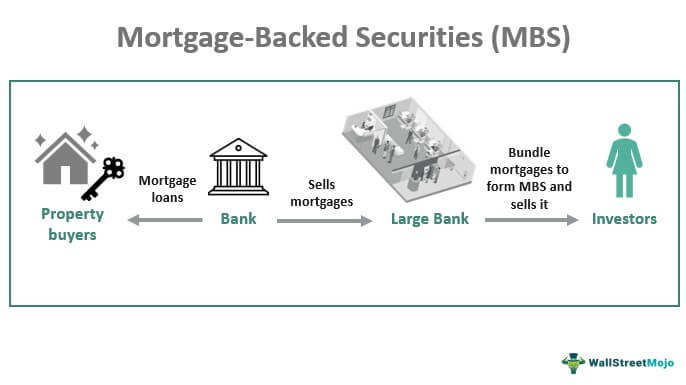

. An MBS is an asset-backed security that is. Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages. Web A mortgage-backed security is an investment instrument in this case a security bond consisting of consumer home loans and commercial real estate loans.

Use NerdWallet Reviews To Research Lenders. Get Instantly Matched With Your Ideal Mortgage Lender. ABS and MBS benefit sellers because they can be removed from the.

Web Mortgage-backed securities MBS are debt obligations that represent claims to the cash flows from pools of mortgage loans most commonly on residential property. Web The Fed currently holds about 26 trillion of MBS as part of its roughly 8 trillion securities portfolio. Web A commercial mortgage-backed security CMBS is a pass-through MBS backed by mortgages on commercial property.

Ad Learn More About American Funds Objective-Based Approach to Investing. Web Mortgage Backed Securities ETFs Mortgage-backed securities are created by restructuring a collection of illiquid mortgage loans into a single tradeable. Web Mortgage-backed securities consist of a group of mortgages that have been structured or securitized to pay out interest like a bond.

MBSs are created by. Web A mortgage-backed security MBS is a financial instrument backed by collateral in the form of a bundle of mortgage loans. Apply Get Pre-Approved Today.

With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Securities with higher coupons offer the potential for greater returns but carry increased. Lock Your Rate Today.

Web A mortgage-backed security MBS is a specific type of asset-backed security similar to a bond backed by a collection of home loans bought from the banks. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. That is about a quarter of the total MBS market what George.

Lock Your Rate Today. Ad Compare the Best House Loans for March 2023. The investors are benefitted from periodic.

Apply Get Pre-Approved Today. Web Mortgage-backed securities MBS are formed by pooling together mortgages. Get Instantly Matched With Your Ideal Mortgage Lender.

Web The reason the Federal Reserve owns mortgage-backed securities goes back to the golden days of the financial crisis of 2008 and 2009 when the Fed was trying. Web Mortgage-backed securities MBSs are bonds that are tied to mortgage loans. Take Advantage And Lock In A Great Rate.

Essentially lenders pool together a large number of mortgage loans to sell to a. A collateralized mortgage obligation or pay.

What Is A Mortgage Backed Security Mbs

Mortgage Backed Security Mbs What Is It Entertainment Heat

Generating Lasting Wealth Springerlink

Primer On Mortgage Backed Securities Part 1

Mortgage Backed Securities Mbs Fannie Mae

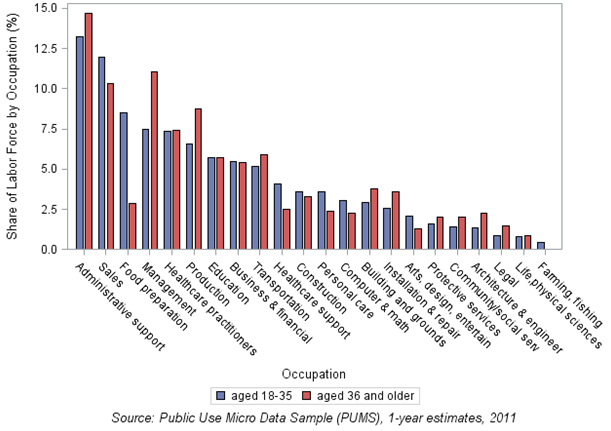

Education And Employment Opportunities For Younger Workers In The Cleveland Msa

Asset Backed Securities An Overview Sciencedirect Topics

36 E Wharf Rd Madison Ct 06443 Realtor Com

![]()

Schuldschein Png Bilder Anzahlungsrechnung Schulden Eingang Gummi Stempel

Stocks Definition Financial Dictionary Fxmag Com

What Are Mortgage Backed Securities The Ce Shop

Mortgage Backed Security Mbs Definition Example

Innovative Proptech Companies By Proptech Switzerland Issuu

6551 Buckskin Trl Cheyenne Wy 82009 Mls 88516 Zillow

:max_bytes(150000):strip_icc()/179001693-5bfc392746e0fb00260ee273.jpg)

Mortgage Backed Securities Mbs Definition Types Of Investment

What Are Mortgage Backed Securities The Ce Shop

Mortgage Backed Security Mbs Definition Example

Komentar

Posting Komentar